Commercial insurance plays a vital role in protecting businesses from financial risks and liabilities that can arise from unforeseen events. Whether you’re a small business owner or a large corporation, having the right commercial insurance coverage is essential for safeguarding your assets and ensuring the continuity of your operations. In this insider’s guide, we will explore the world of commercial insurance, specifically focusing on the California market. We will take a closer look at the key considerations for commercial insurance in California, with a specific focus on restaurant insurance and commercial auto insurance. By understanding these aspects, you will be better equipped to navigate the complex world of commercial insurance and make informed decisions that best suit your business’s unique needs. So, let’s dive in and explore the ins and outs of commercial insurance in California!

Understanding Commercial Insurance in California

Commercial insurance is an essential aspect of protecting businesses in California. With the diverse and dynamic economy in the state, it is crucial for business owners to have a clear understanding of commercial insurance and its significance. This guide will provide valuable insights into commercial insurance in California, focusing specifically on the needs of restaurants and commercial auto insurance.

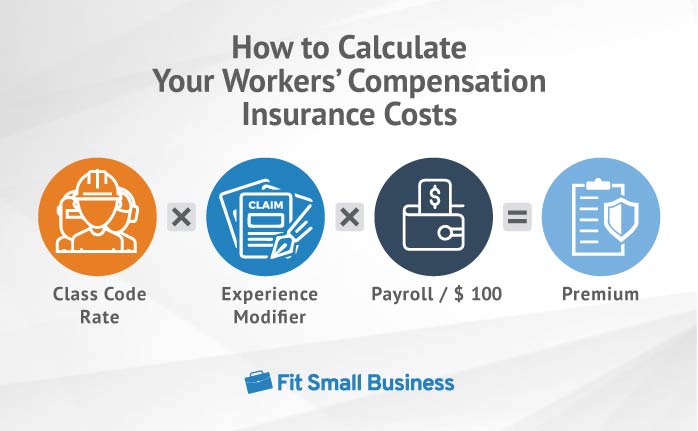

California, being home to numerous thriving industries, requires businesses to have the necessary insurance coverage to safeguard their interests. Commercial insurance in the state typically encompasses several types of coverage, including property insurance, liability insurance, and workers’ compensation insurance. These policies provide protection against potential risks and help businesses bounce back in case of unforeseen events such as property damage, lawsuits, or employee injuries.

Restaurants, being a significant part of the economy in California, require specialized insurance coverage tailored to their unique needs. Restaurant insurance in California offers protection against various risks specific to the foodservice industry, including general liability, property damage, liquor liability, and workers’ compensation. It is crucial for restaurant owners to have a comprehensive understanding of the insurance requirements and options available to them in order to adequately protect their business and assets.

For businesses that rely on vehicles for their operations, commercial auto insurance is a necessity. In the vast landscape of California, where transportation is vital for many industries, having proper coverage for commercial vehicles is crucial. Commercial auto insurance offers protection against accidents, theft, and damage to both owned and leased vehicles. It is important for businesses to assess their specific needs and choose the right level of coverage to ensure the smooth operation of their commercial vehicles while adhering to California’s insurance regulations.

By having a solid grasp of commercial insurance in California, business owners can navigate the complex insurance landscape with confidence. Understanding the different types of coverage available and the specific requirements for industries such as restaurants and commercial auto will enable businesses to make informed decisions and purchase policies that provide the necessary protection for their operations.

A Guide to Restaurant Insurance in California

When it comes to running a restaurant in California, having the right insurance coverage is crucial. California, being a bustling hub for food enthusiasts, requires restaurant owners to protect their businesses against various risks. In this guide, we will explore the ins and outs of restaurant insurance in California, helping you navigate the complexities and find the right coverage for your establishment.

First and foremost, one of the most important types of insurance for restaurant owners in California is general liability insurance. This coverage protects you from potential lawsuits arising from bodily injury or property damage that may occur on your premises. For example, if a customer slips and falls on a wet floor in your restaurant, general liability insurance can help cover the costs of any resulting medical expenses or legal fees.

Additionally, it is crucial for restaurant owners to consider property insurance. Given the high property values in California, protecting your restaurant and its physical assets from perils such as fire, theft, or vandalism is essential. Property insurance can provide coverage for your building, equipment, furniture, and other contents, giving you peace of mind knowing that you are financially safeguarded in case of an unfortunate event.

Furthermore, as a restaurant owner, you may also need commercial auto insurance if your establishment offers delivery services. When you have employees using company vehicles or even their personal vehicles for work-related purposes, commercial auto insurance can protect you and your drivers from accidents and liabilities on the road. It is essential to ensure that your coverage adequately protects your vehicles and drivers, especially considering the busy roads and congested traffic in California.

In conclusion, navigating the world of restaurant insurance in California can seem overwhelming, but with the right knowledge, you can find peace of mind knowing that your business is protected. General liability insurance, property insurance, and commercial auto insurance are just some of the coverage options to consider. Make sure to assess your specific needs and consult with insurance experts to find the best policy that suits your restaurant’s requirements.

Navigating Commercial Auto Insurance in California

In California, having commercial auto insurance is crucial for businesses that rely on vehicles to carry out their operations. It provides coverage and protection in the event of accidents, property damage, or injuries involving company-owned vehicles. Selecting the right commercial auto insurance policy can be overwhelming, but with the right information, you can navigate this process successfully.

When searching for commercial auto insurance in California, it’s essential to understand the coverage options available to you. Policies typically include liability coverage, which protects against bodily injury and property damage caused by your company’s vehicles. Additionally, comprehensive and collision coverage can be added to protect against theft, vandalism, and damage to your vehicles from accidents.

Consider the specific needs of your business when selecting a commercial auto insurance policy. If you own a restaurant in California, for example, you might require additional coverage tailored to the unique risks associated with your industry. Restaurant insurance is designed to protect against potential damages caused by food spoilage, equipment breakdowns, or employee-related incidents. By understanding the specific requirements of your business, you can ensure that your commercial auto insurance policy provides adequate coverage.

Navigating the world of commercial auto insurance in California may seem challenging, but with the right resources and knowledge, you can make informed decisions. Consult with insurance professionals who specialize in commercial policies to better understand your options and any regulations specific to the state. By doing your due diligence and seeking expert guidance, you’ll be equipped with the necessary tools to navigate the intricacies of commercial auto insurance and protect your business in California.